The Government of India administers the Mahila Samman Saving Certificate Scheme to provide small investment opportunities to women citizens. With the help of this scheme, women and girls from across the country can open investment accounts in public sector banks and eligible private banks. The Mahila Samman Savings Certificate is an investment scheme that provides small investment opportunities up to a maximum of INR 2.00 lakh to women and girls. Under this scheme, eligible women and girls can submit their applications to the public sector banks, eligible private banks, and post offices in all states and union territories in India. Read below to check all the crucial details about the Mahila Samman Saving Certificate Scheme 2024.

Launch of the Mahila Samman Savings Certificate

The Mahila Samman Saving Certificate Scheme was launched by the Department of Economic Affairs, Ministry of Finance, through an e-gazette notification issued on June 27, 2023, and became operational with effect from April 1, 2023. This is a term-based small investment scheme that will be operational for two years up to 31st March 2025. Women and girls from all backgrounds can fill out the application form and submit the same to the nearest bank or post office branch to open the account for this purpose.

The scheme enables all eligible women and girl citizens to deposit at least INR 1000 and any sum in multiple of 100 up to a maximum of INR 2.00 lakhs. An annual interest rate of 7.5% will be earned on the invested value which will compound quarterly.

Mahila Samman Saving Certificate Details in Summary

| Name of Scheme | Mahila Samman Saving Certificate Scheme |

|---|---|

| Concerned Government | The central Government of India |

| Ministry | Ministry of Finance |

| Concerned Department | The Department of Economic Affairs |

| Scheme type | Investment Scheme |

| Benefits | Earning of compound interest on investment |

| Maximum Investment Limit | Up to INR 2,00,000 |

| Application Process | Offline |

| Official Website | https://dea.gov.in/ |

Aims and Objectives

The main aim behind launching the Mahila Samman Savings Certificate is to provide a term-based small investment option to women and minor girls. Through this scheme, women can open investment accounts for themselves and their minor girl children and will earn interest benefits. This will empower women financially and their living conditions will improve significantly in the long run. This scheme will also guide women in managing their finances efficiently and developing a sense of investment.

See Also: Pradhan Mantri Matru Vandana Yojana

Key Features and Financial Benefits

- This is an attractive and secured small investment option launched by the Government of India for women and girls.

- A minimum of INR 1000 and any sum in multiple of 100 with an upper ceiling of INR 2,00,000 can be invested in this scheme.

- An annual interest of 7.5% will be accorded to investment values in each account under the Mahila Samman Saving Certificate.

- The value of the MSSC account will be compounded quarterly.

- One can apply for this scheme before the 31st of March 2025 in any public sector bank, eligible private bank, and post office.

- The maturity period for this investment will be 2 years from the date of opening of the account.

Payment on Maturity

- On completion of two years from the date of the deposit, the deposit will be deemed matured, and the eligible amount will be paid to the account holder.

- In the calculation of the maturity value, any amount in a fraction of a rupee shall be rounded off to the nearest rupee. For this purpose, the following conditions will apply:

- Any amount of fifty paisa or more shall be treated as one rupee.

- Any amount less than fifty paisa shall be ignored.

Partial Withdrawal

- The account holder can request a partial withdrawal from the account after one year of deposit and before the maturity date.

- In partial withdrawal, a maximum of up to 40% of the eligible balance can be withdrawn by the beneficiary.

- In case of an account opened for a minor girl, the guardian may apply for the withdrawal for the benefit of the minor girl.

- For this purpose, the guardian will have to submit the specified certificate to the accounts office.

- While calculating the withdrawal amount, any amount in a fraction of a rupee shall be rounded off to the nearest rupee.

Eligibility Criteria for Mahila Samman Saving Certificate

- The applicant must be an Indian citizen.

- Only women and girl children will be eligible for the MSSC Scheme.

- Any individual woman can open an MSSC account irrespective of age and family background.

- The account for minor girl children can be opened by a parent or guardian.

- The account opened for the Mahila Samman Saving Certificate shall be a single-holder type account.

Required Documents

- Aadhaar Card

- PAN Card

- Proof of age, i.e. Birth Certificate or Matriculation Certificate

- One of the following documents for identification and address proof

- Driving license

- Passport

- Voter ID card

- MNREGA Job card

- Letter issued by the National Population Register containing details of name and address

- Passport-sized Photograph

See Also: Pradhan Mantri Rojgar Yojana

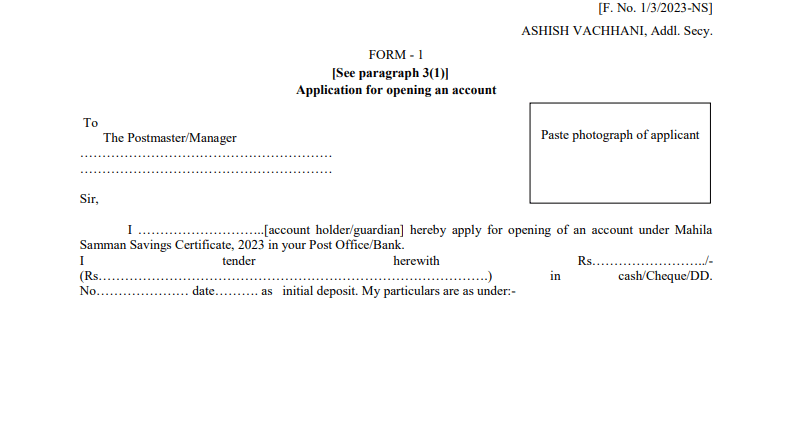

Application Process for Mahila Samman Saving Certificate

- To apply and open an account for MSSC, applicants can visit the nearest post office branch or a designated bank branch.

- Collect the application form from the counter free of charge.

- One can also download the MSSC Application Form from the official website.

- Fill out the application form with all necessary information.

- Attach the attested copy of the necessary documents.

- Fill out the declaration and nominee details and submit the application form with the initial amount of investment/deposit to the counter.

- Collect the certificate from the counter, as the same will serve as proof of investment in the Mahila Samman Savings Certificate scheme.

Premature Closure of MSSC Account

An account cannot be closed before its maturity, except in the following situations:

- If the account holder passes away.

- If the account holder faces extreme hardship, such as needing medical treatment for a life-threatening disease or losing a guardian, and the post office or bank approves after reviewing all documents.

- If an account is closed early, the interest will be paid at the rate applicable to the scheme for which the account has been held.

- After six months from opening the account, premature closure can be allowed for reasons not mentioned above. In such cases, the interest shall be 2% lower than the regular rate.

- For maturity value calculation, any fractional rupee will be rounded. Amounts of fifty paisa or more will be rounded to the next rupee, while amounts less than fifty paisa will be ignored.

Frequently Asked Questions

Which government administers the Mahila Samman Saving Certificate Scheme?

The Government of India administers the Mahila Samman Saving Certificate scheme.

Who can apply for the MSSC Scheme?

Women and minor girl children are eligible for the MSSC Scheme.

How much amount can be invested in the MSSC Account?

A minimum of INR 1000 and any sum in multiple of 100 with a maximum limit of INR 2,00,000 can be deposited.

When is the last date for the Mahila Samman Saving Certificate?

The last date to apply for the Mahila Samman Saving Certificate is the 31st of March 2025.

What is the rate of interest for the MSSC Deposit?

The rate of interest is 7.5% per annum, which will be compounded quarterly.

What is the maturity period for investments under the MSSC Scheme?

The maturity period will be 2 years from the date of deposit.

What is the application process for the Mahila Samman Savings Certificate?

The application process is offline, and you can visit any public sector bank, eligible private bank, and nearest post office branch to open the MSSC account.