Finance Minister Smt. Nirmala Sitharaman has launched NPS Vatsalya Scheme recently. This is a big initiative launched for children to get access to pension services. Under this scheme, now, minor children below the age of 18 can apply for pension account and subscribe to NPS Vatsalya under National Pension System. Through this scheme, government of India has paved way for minor to invest a minimum of 1000 rupees annually and secure their future. Once the minor attains the age of 18, the pension account will be converted into regular NPS account.

If you want to secure the future of your children, then you should read this article till the end. In this article, we have provided all the information about NPS Vatsalya Scheme clearly and step by step which by reading and understanding till the end you will be able to apply and make subscription to NPS Vatsalya Scheme. Lets start and know each and every details of this new pension program for minors.

About NPS Vatsalya Scheme 2024

Finance Minister Nirmala Sitharaman has launched this scheme on 18th of September 2024 stating this would secure futures of India and provide more financial security to minors. Under this initiative, a minimum of 1000 rupees can be invested per year and on attaining the age of 18 by the subscriber, the account will be converted into regular NPS Account. There is no upper limit set for investment under NPS Vatsalya. Money invested into NPS Vatsalya will earn compound interest thus can provide much benefits in long run. One can make subscription to it by visiting the official website or a scheduled nationalized bank.

Highlight of NPS Vatsalya Scheme 2024

| Scheme | NPS Vatsalya Scheme |

|---|---|

| Concerned Government | Government of India |

| Department | Department of Financial Services and PFRDA |

| Launch date | September 18, 2024 |

| Objectives | To provide pension security to minors |

| Minimum investment | 1000 rupees per year |

| Maximum investment limit | No limit |

| Application Process | Online/Offline |

| Official Website | https://enps.nsdl.com/eNPS/NationalPensionSystem.html |

NPS Vatsalya Objectives

Till now many types of pension schemes have been implemented in the country, in which all the schemes have been run only for adult citizens. Keeping in mind the need of the hour, the Government of India has decided to start NPS Vatsalya, which is very important because now through this pension scheme it will be possible to secure the future of the young children of the country. By subscribing to this scheme, parents / guardians will be able to lay the foundation for a better future for their children as they will get financial support to fulfill their education and health needs and their tomorrow will be better.

NPS Vatsalya Scheme 2024 – Benefits and Key Features

What are the benefits of the NPS Vatsalya scheme launched by the central government and what are the main features of this scheme can be understood from the points given below.

- NPS Vatsalya Yojana has been started to connect young children in the country with pension.

- Under this, it has become possible to open pension accounts for children below the age of 18 years.

- This will be very important from the point of view of securing the future of children by parents or guardians.

- Under this pension scheme, a minimum investment of Rs 1000 has to be made annually.

- At the same time, no maximum investment limit has been set under this.

- When the child turns 18 years old, this account will be converted into a standard NPS account.

- There will be a lock-in period of 3 years on the amount deposited in the NPS pension account, that is, no amount can be withdrawn from this account during initial 3 years.

- Compound interest will be received on the amount deposited by the subscriber in the NPS account, that is, interest will also be received on the principal and the interest earned on it.

- In this way, NPS Vatsalya will prove to be a milestone in securing the future of the children of the country.

NPS Vatsalya Scheme 2024 – Terms & Conditions

The terms and conditions issued by the government under NPS Vatsalya can be understood from the points given below.

- If a parent or guardian subscribes to NPS Vatsalya for their child, they will first have to get the child’s PAN card and Aadhaar card made.

- The amount deposited in NPS Vatsalya will remain in a lock-in period of three years, during which no amount can be withdrawn from it.

- After the lock-in period is over, the amount can be withdrawn from this pension account three times till the age of 60 years.

- The amount withdrawn in this way will be 25% of the total investment, which can be withdrawn only in case of education, serious illness and disability and for this, the subscriber will have to submit the necessary documents.

- When the subscriber turns 18 years of age, it will be converted into a regular NPS account in which the contribution will continue for 60 years.

- When the subscriber turns 60 years of age, he/she can withdraw 20% of the amount from his pension account in lump sum, while he will have to buy annuity with 80% of the amount, which will give him/her interest based pension every month.

- Subscribers who have less than Rs 2.5 lakh in their account after the age of 60 years can withdraw the entire amount in lump sum.

NPS Vatsalya Scheme Eligibility

If you want to subscribe to NPS Vatsalya for your children, then you have to understand the eligibility of this scheme. There is no special eligibility requirement for NPS Vatsalya, but to open your child’s NPS account, it will be necessary to fulfill the conditions given in the points below.

- The subscriber must be below 18 years of age.

- Parents or guardians can open an account on behalf of the child.

- The child must have his/her own Aadhaar card and PAN card.

- Non-resident Indians (NRIs) can also open a pension account for their child under the NPS scheme.

Documents Required

- Date of Birth Proof of Minor

- Guardian Signature

- Scanned Copy of Passport (Applicable only for NRI Subscribers)

- Scanned copy of Foreign Address Proof (Applicable only for OCI Subscribers)

- Scanned copy of Bank Proof (Applicable only for NRI/OCI Subscribers)

How to apply for NPS Vatsalya Scheme 2024

To apply and make subscription to NPS Vatsalya Scheme, you need to do either some online steps or can visit your nearest national bank branch. Online application process for NPS Vatsalya Scheme is as under.

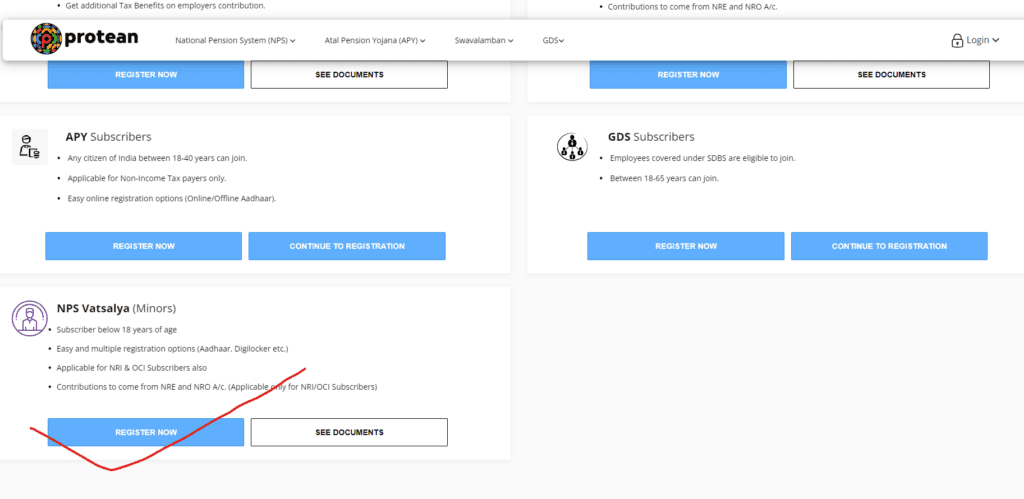

- First of All visit the official website of eNPS.

- The home page of the website will appear on your screen.

- Now, scroll a bit and you will see NPS Vatsalya (Minors) section.

- Under this section, you have to click on Register Now button.

- A popup form will appear on your screen.

- Now, enter Date of Birth, Permanent account number (PAN), Mobile number, email id and click on Begin Registration.

- Now completer the registration process and kyc and submit your application.

- At the end of the process, you will receive the PRAN that is Permanent Retirement Account Number, Keep it in a safe place.

Useful Links

| Name of Scheme | NPS Vatsalya Scheme |

|---|---|

| Official Website Link | Click Here |

| Yojana King Home | Click Here |